In an Urban Institute Study, it was founded that homeowners who purchased a house before they were 35, were generally better prepared for retirement at age 60. And it appears that the younger generation are strong believers in homeownership.

According to a Freddie Mac survey,

“The dream of homeownership is alive and well within “Generation Z”, the demographic cohort following Millennials.”

Our survey…finds that Gen Z views homeownership as an important goal. They estimate that they will attain this goal by the time they turn 30 years old, three years younger than the current median homebuying age (33).”

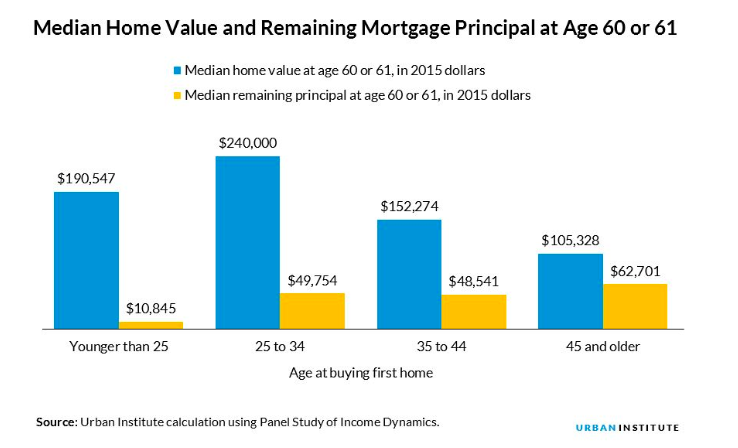

Homeowners who bought their first home before 25 had a lower median house value when they were older and lower mortgage debt because they have owned their home longer. Their median remaining principal on the house was less than $11,000 which was considerably lower than the other three groups.

Those who purchased their first home between ages 25 and 34 typically had the greatest housing wealth by their sixties. There is a $72,000 difference in the median housing wealth of those who bought their first home between ages 25 and 34 and those who waited until they were 35 to 44. If they wait until they are 45 or older, the median wealth is more than $100,000 lower. Homeowners who bought their first home between the ages of 25 and 34 tend to have the greatest housing wealth by their sixties.

Although a goal of the younger generation is to own a home they reported that they are not confident in the process of purchasing a home.

If you are wanting to purchase a home but are not sure where to start, contact us! We would be happy to help you find your next home.

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve.

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve.