How to Price Your Home For Today’s Market (And Any Market, Really)

We all know about buyer’s remorse. What about seller’s regret? According to Zillow, 84% of those who sold a home for the first time between late 2020 and 2022 wish they did something differently. 39% of these sellers wish they set a higher listing price. Understanding the market to get the most optimal price is a common challenge. Market conditions this year might make it harder. High mortgage rates, falling demand, low inventory – we’re headed for a spring selling season unlike any other. Here’s how to lock in a price strategy before listing.

Determine Your Priorities

Ask yourself: Why am I selling, and how fast do I need to sell my home? Are you relocating for work and need to sell quickly? Or are you retiring, and need to maximize your nest egg? Figuring out a timeline, as well as how you will invest that money is a crucial first step in the sale process.

Find the Right Real Estate Agent

“This is a market where you really want a pro,” says Amanda Pendleton, a home trends expert at Zillow. Hire a professional who’s deeply experienced in your local market and has sold similar properties to your own. They should have insight on “every single competitor in the market and the differences between alternative homes and yours,” says John Walkup, co-founder of real estate data firm UrbanDigs.

Get a Comparative Market Analysis

A CMA will give you an in-depth report on your home’s current value, considering location, age, size, construction, style and condition, as well as other comparable properties, or “comps”, in your neighborhood. Use it as a starting point, or inspiration to make certain upgrades to boost the value of your home. Focus on recent sales, active listings, those in contract or homes that have been pulled off the market. Bedrooms, bathrooms, square footage, and amenities are important to consider.

Meet the Market Where It’s At

Mortgage rates are setting the tone for buyers across the country. In March, the typical monthly mortgage payment was up 26% compared to a year ago, according to Zillow. Buyers who could afford a $350,000 home in 2022 might not be able to anymore. You should consider rates, which change week to week, when coming up with your asking price, and how they’re affecting demand in your area.

Develop a Strategy

You want the best possible price for your home, but pricing it too high could lead to a slower sale and price cuts. “There are three basic pricing strategies: at, below, or above perceived market value,” says Mihal Gartenberg, a broker at Coldwell Banker Warburg. “The strategy that leads to the most showings, fastest close, and ability to close above ask is pricing below perceived market value.” If it’s under $1 million, she suggests pricing about $25,000 lower than the perceived market value, while higher price points round down $50,000 to $100,000. Mr. Walkup suggests that sellers determine a “best possible price” for their home, followed by a value proposition. Discounting your best possible price as little as 2% to 3% will bring more buyers in the door, he says.

Reassess After Two Weeks

Take an honest look at your listing about 14 days after it’s gone live. “Those first two weeks are critical – it’s when we see listings get the most traffic,” said Amit Arora of iBuying firm Opendoor. If you’re hearing crickets, it’s likely a sign your listing isn’t matching buyer expectations and it might be soon time to recalibrate.

Article Courtesy of The Wall Street Journal

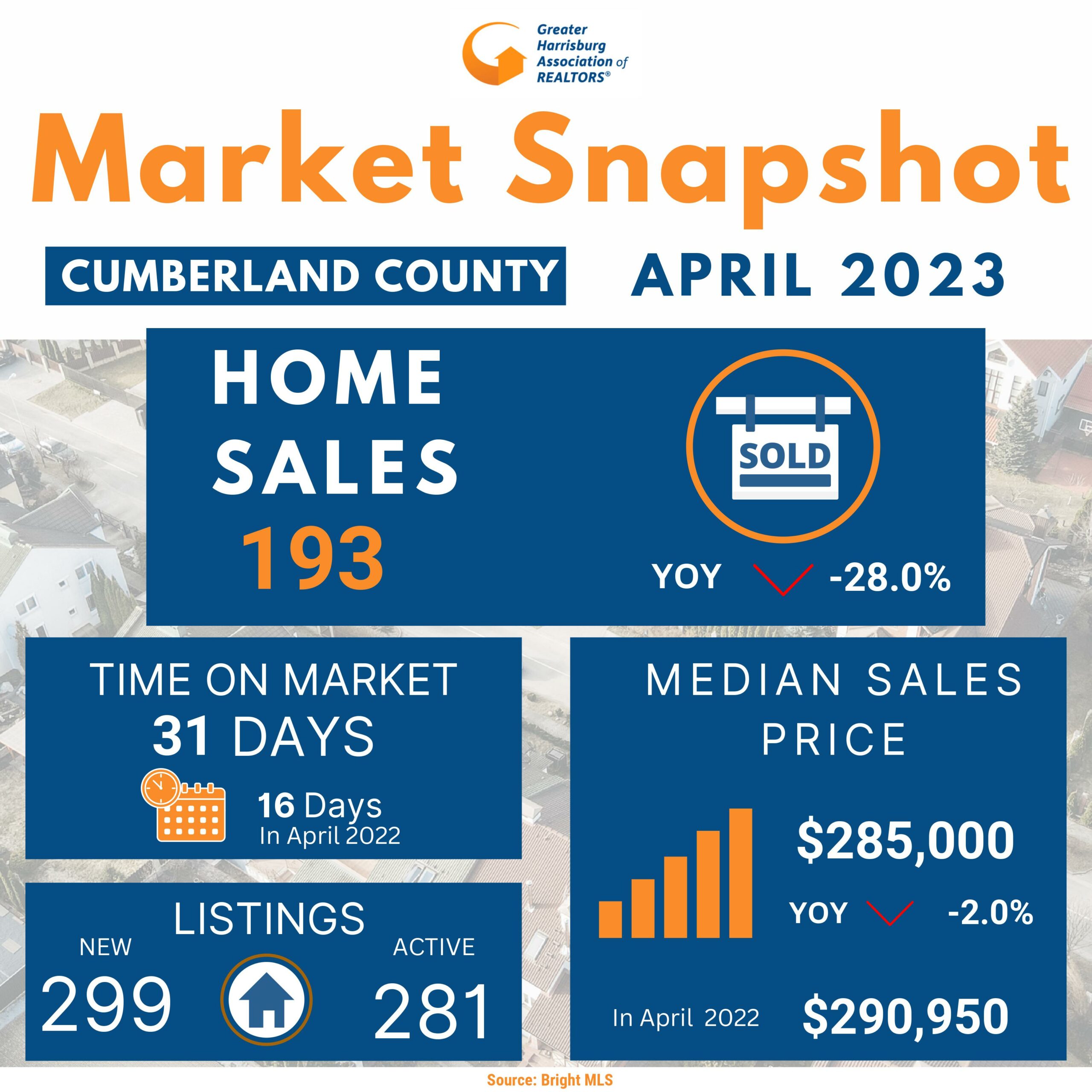

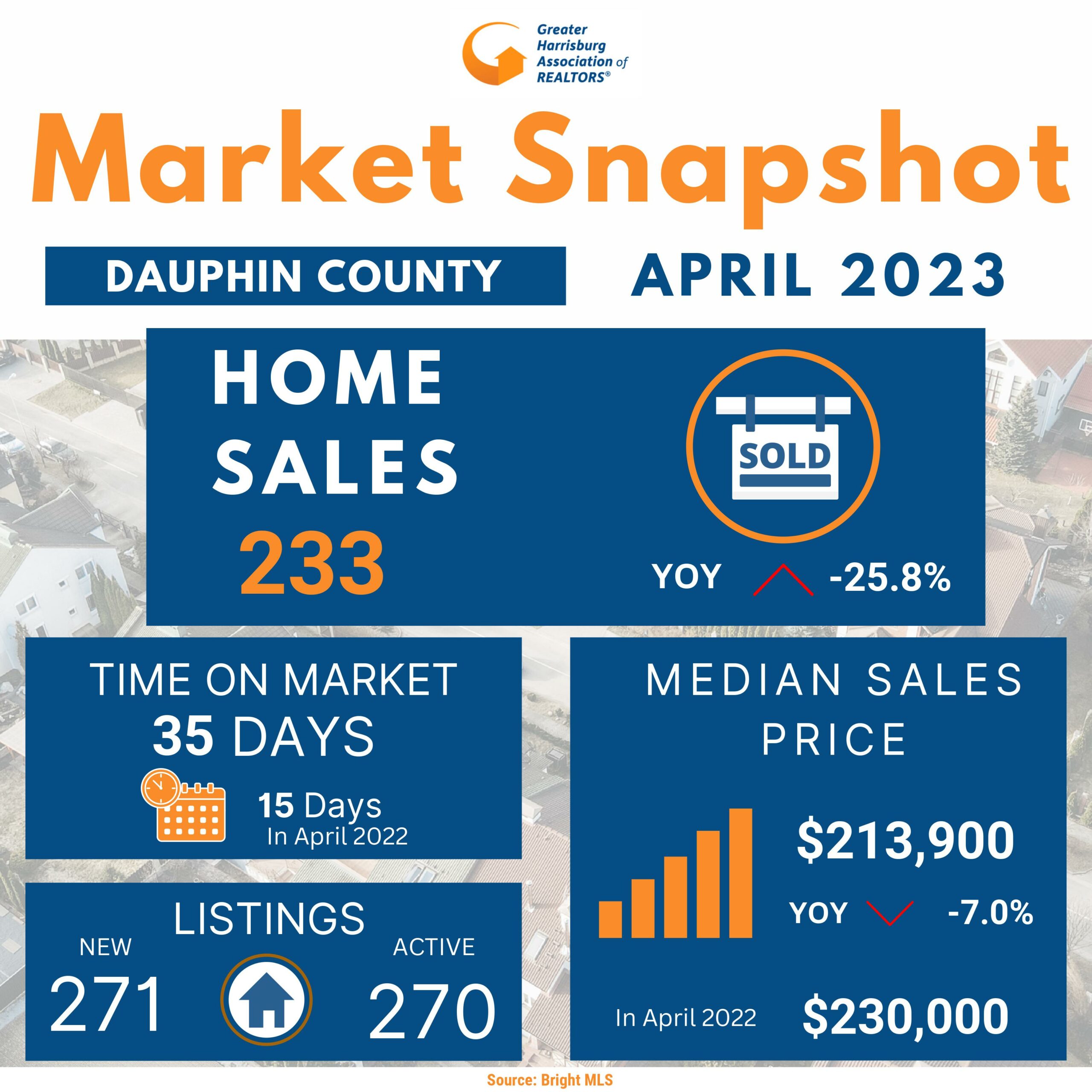

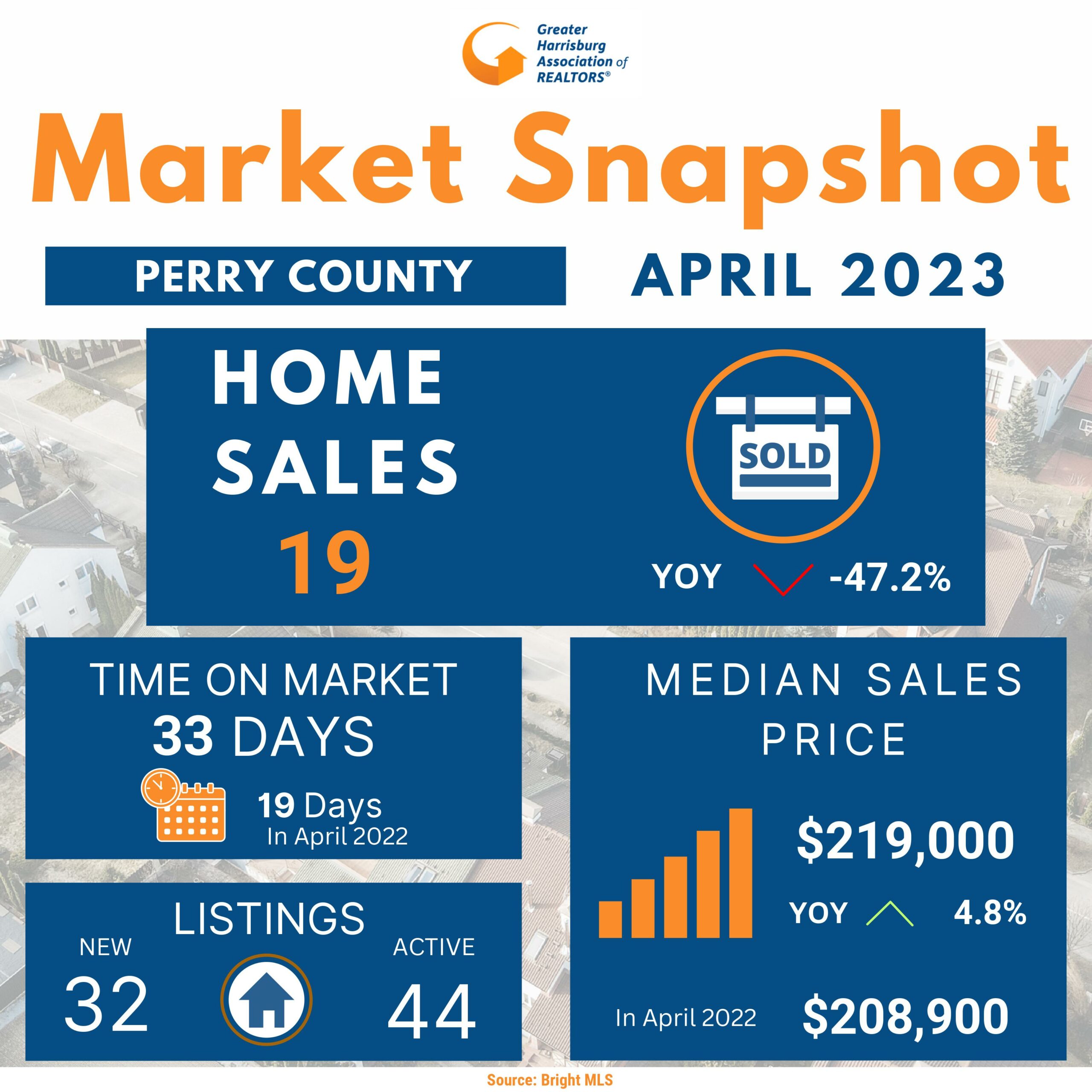

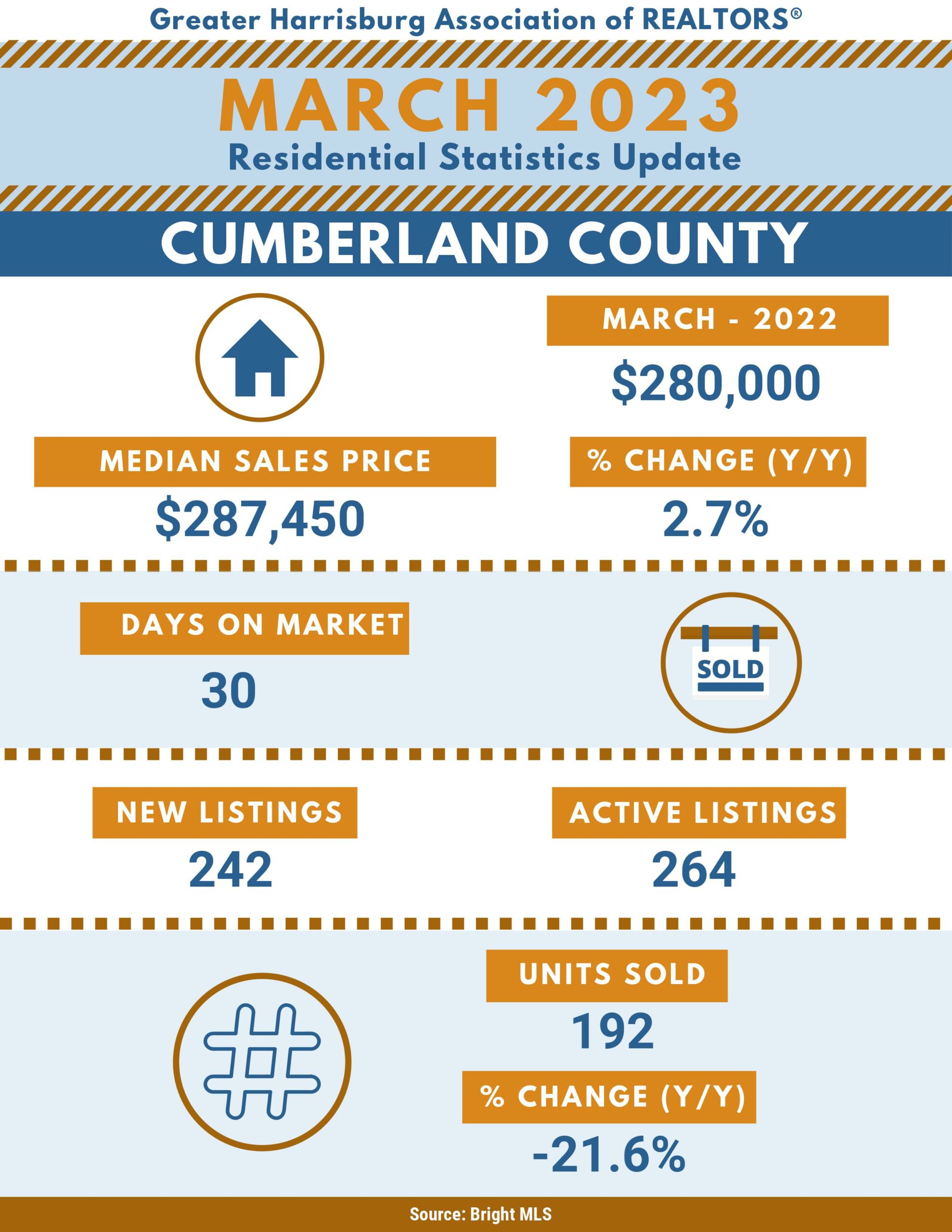

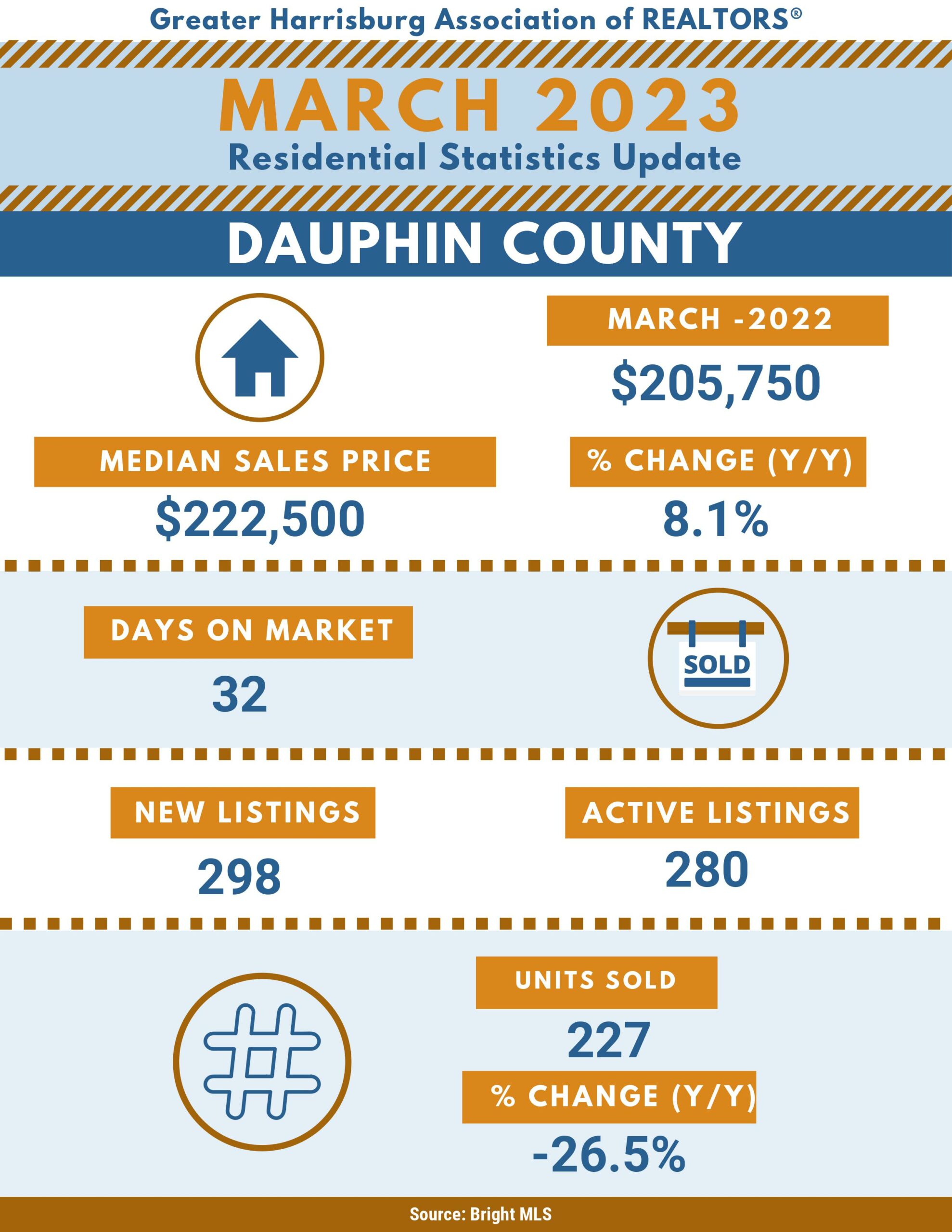

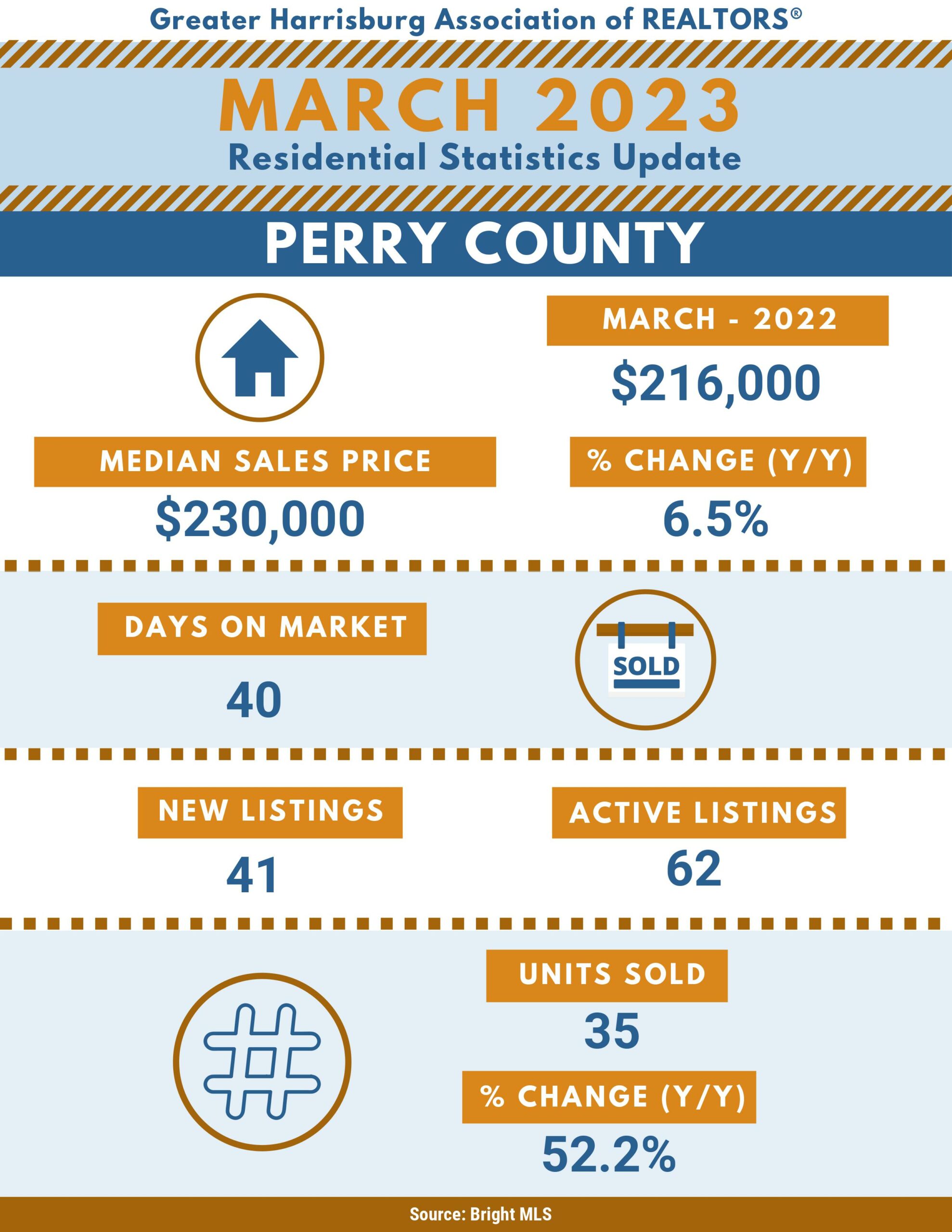

March 2023 Market Update

Think Twice Before Waiting for Lower Home Prices

As the housing market continues to change, you may be wondering where it’ll go from here. One factor you’re probably thinking about is home prices, which have come down a bit since they peaked last June. And you’ve likely heard something in the news or on social media about a price crash on the horizon. As a result, you may be holding off on buying a home until prices drop significantly. But that’s not the best strategy.

A recent survey from Zonda shows 53% of millennials are still renting right now because they’re waiting for home prices to come down. But here’s the thing: the most recent data shows that home prices appear to have bottomed out and are now on the rise again. Selma Hepp, Chief Economist at CoreLogic, reports:

“U.S. home prices rose by 0.8% in February . . . indicating that prices in most markets have already bottomed out.”

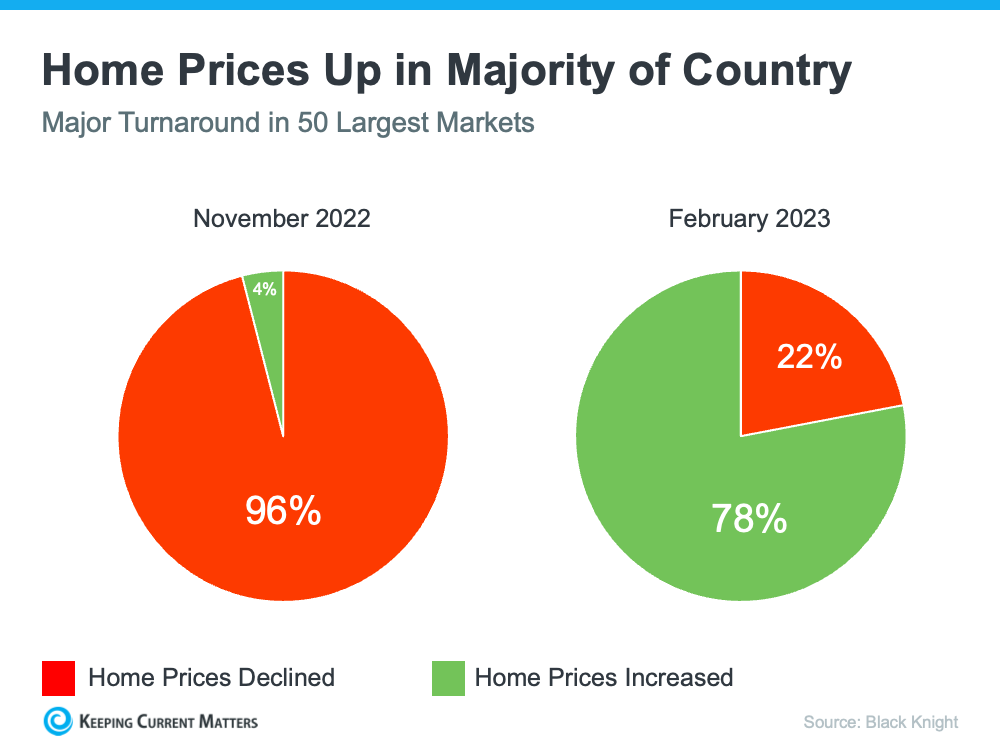

And the latest data from Black Knight shows the same shift. The graph below compares home price trends in November to those in February:

So, should you keep waiting to buy a home until prices come down? If you factor in what the experts are saying, you probably shouldn’t. The data shows prices are increasing in much of the country, not decreasing. And the latest data from the Home Price Expectation Survey indicates that experts project home prices will rise steadily and return to more normal levels of appreciation after 2023. The best way to understand what home values are doing in your area is to work with a local real estate professional who can give you the latest insights and expert advice.

Bottom Line

If you’re waiting to buy a home until prices come down, you may want to reconsider. Work with an agent to make sure you understand what’s happening in your local housing market.

Article courtesy of Keeping Current Matters

We’re in a Sellers Market. What Does That Mean?

Even though activity in the housing market has slowed from the frenzy we saw over a year ago, today’s low supply of homes for sale is still a sellers’ market. But what does that really mean? And why are conditions today so good if you want to list your house?

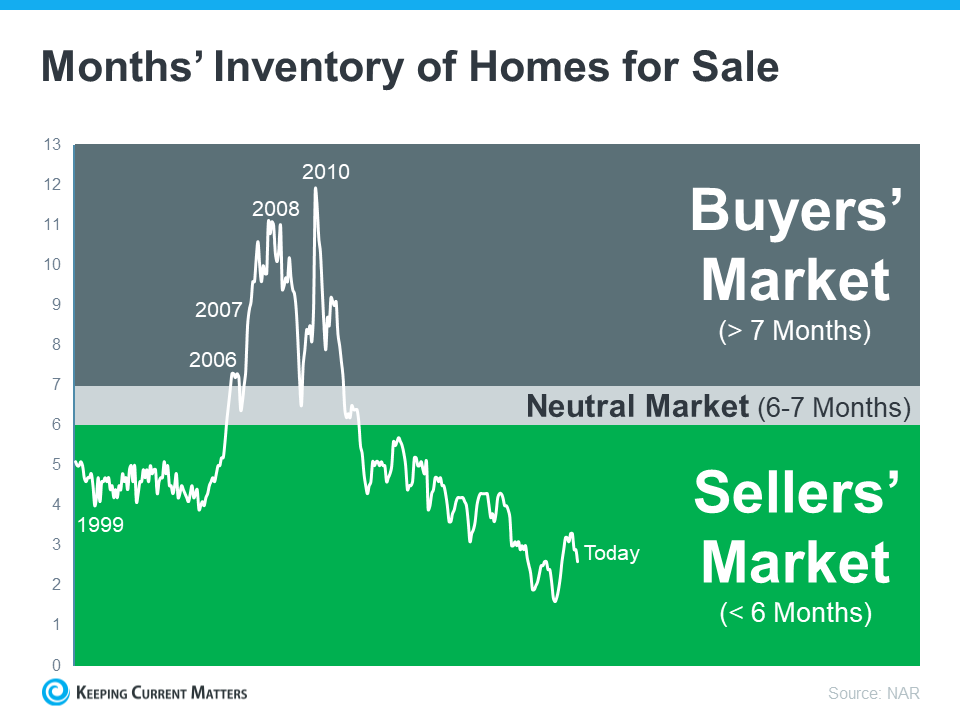

It starts with the number of homes available for sale. The latest Existing Home Sales Report from the National Association of Realtors (NAR) shows housing supply is still astonishingly low. Today, we have a 2.6-month supply of homes at the current sales pace. Historically, a 6-month supply is necessary for a ‘normal’ or ‘neutral’ market in which there are enough homes available for active buyers (see graph below):

What Does This Mean for You?

When the supply of homes for sale is as low as it is right now, it’s much harder for buyers to find one to purchase. That creates increased competition among purchasers and keeps upward pressure on prices. And if buyers know they’re not the only one interested in a home, they’re going to do their best to submit a very attractive offer. As this happens, sellers are positioned to negotiate deals that meet their ideal terms. Lawrence Yun, Chief Economist at NAR, says:

“Inventory levels are still at historic lows. Consequently, multiple offers are returning on a good number of properties.”

Right now, there are still buyers who are ready, willing, and able to purchase a home. If you list your house right now in good condition and at the right price, it could get a lot of attention from competitive buyers.

Bottom Line

Today’s sellers’ market can be a great time for homeowners ready to make a move. Listing your house now will maximize your exposure to serious, competitive buyers. Connect with a local real estate professional to jumpstart the selling process.

Article courtesy of Keeping Current Matters

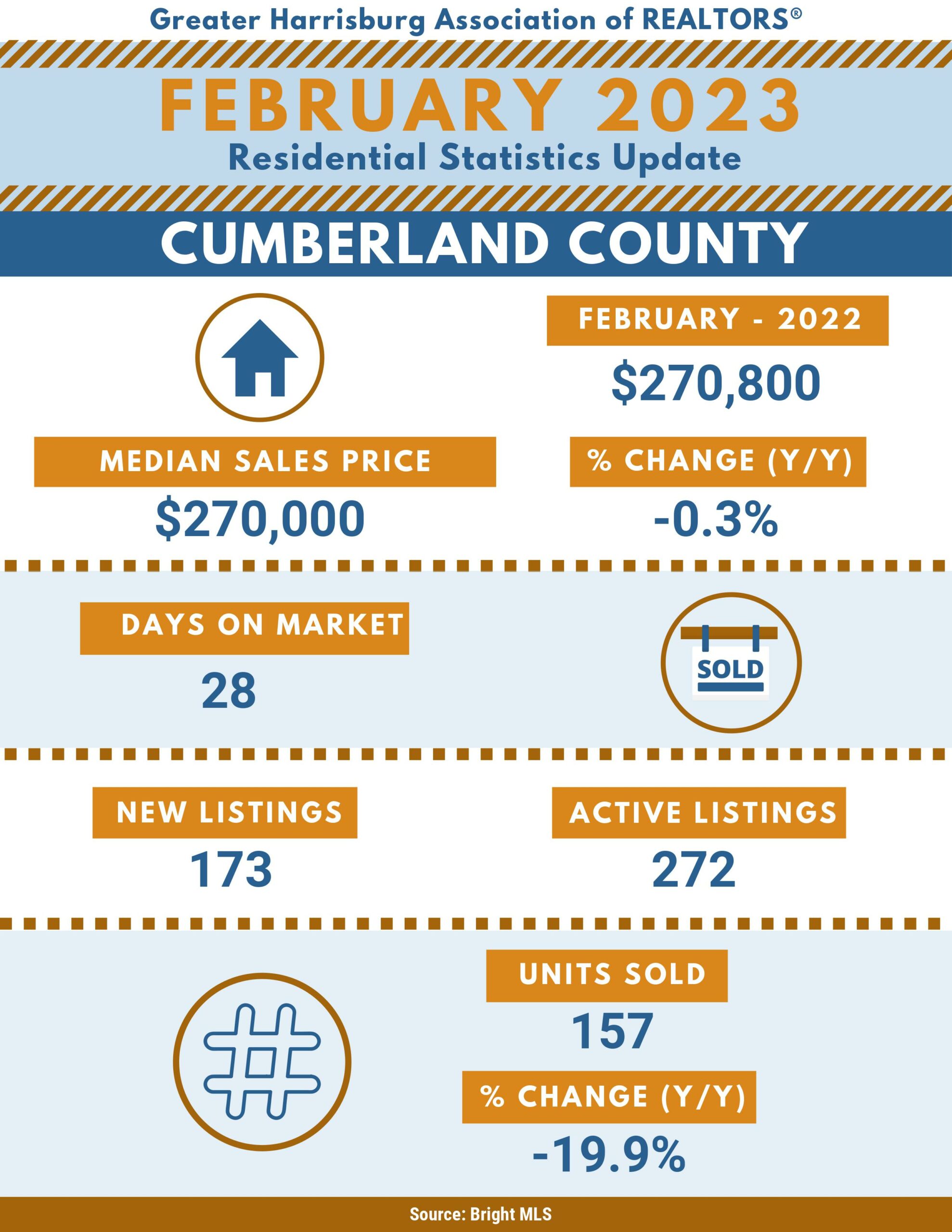

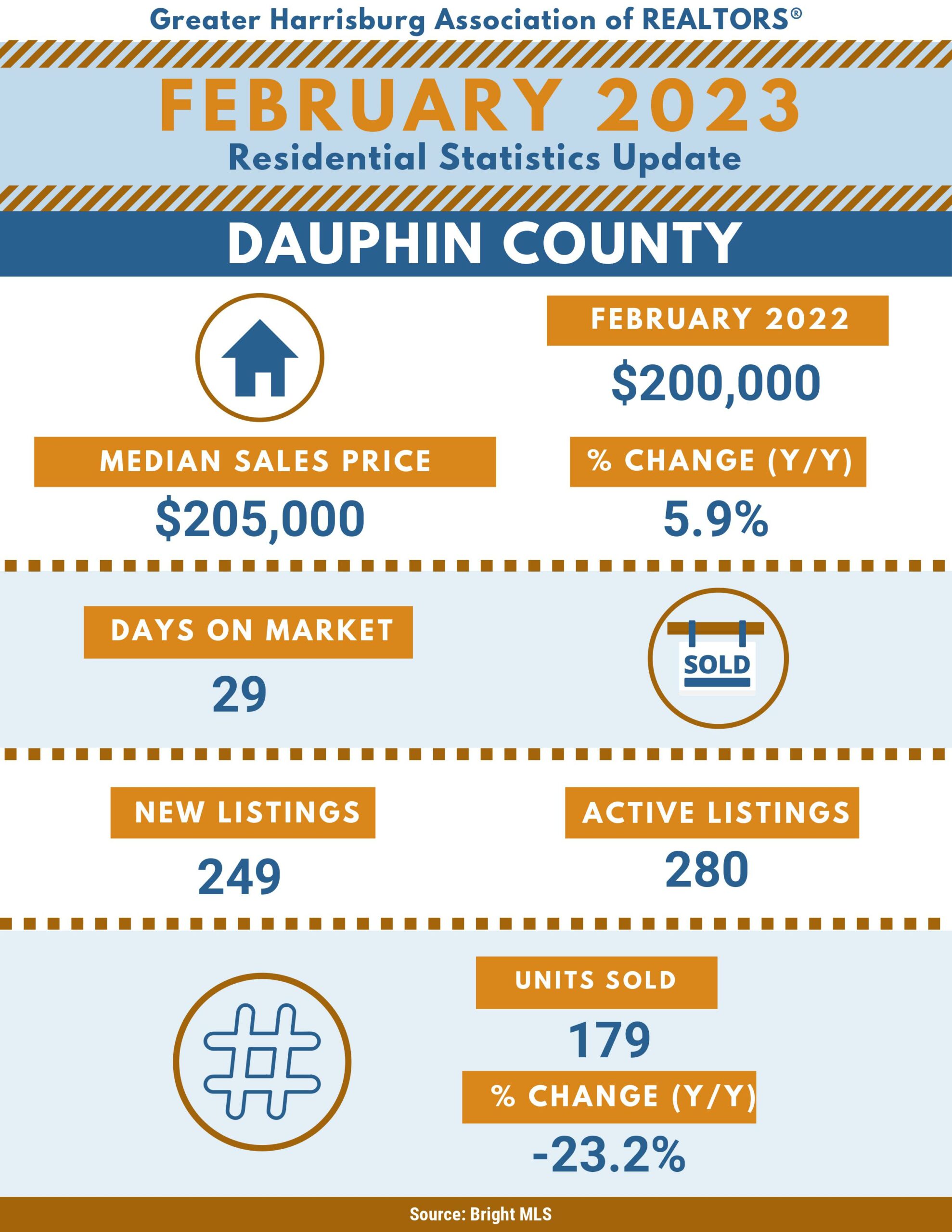

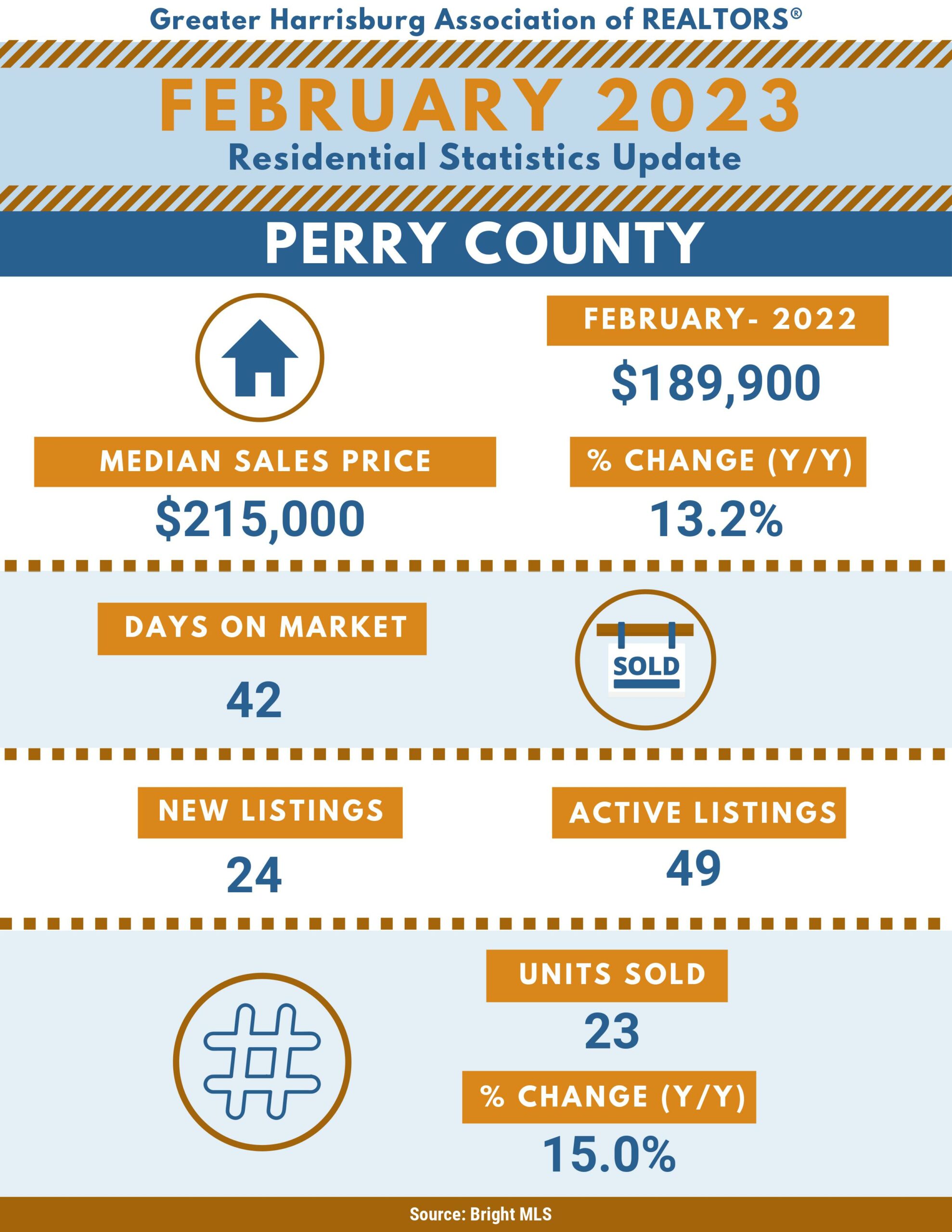

February 2023 Market Update

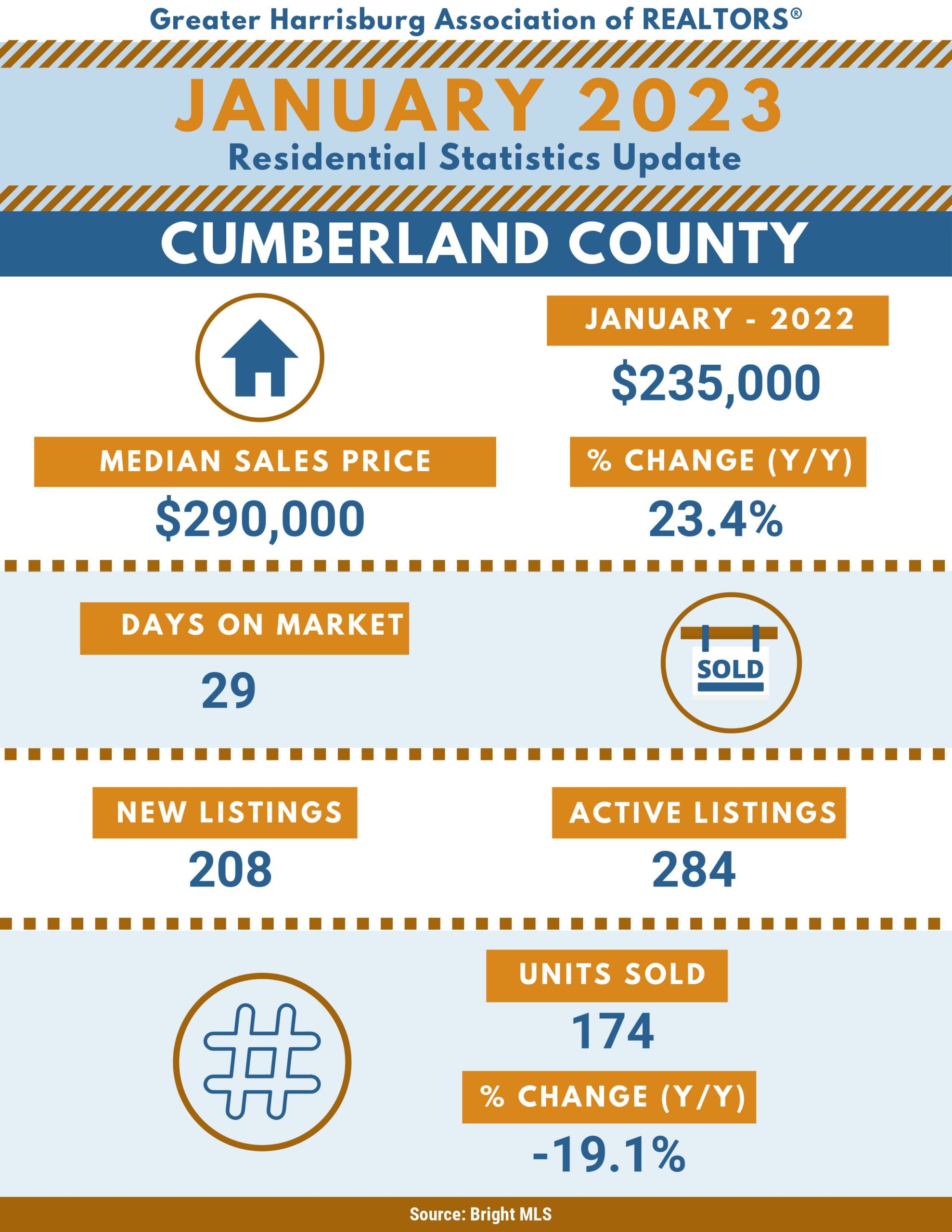

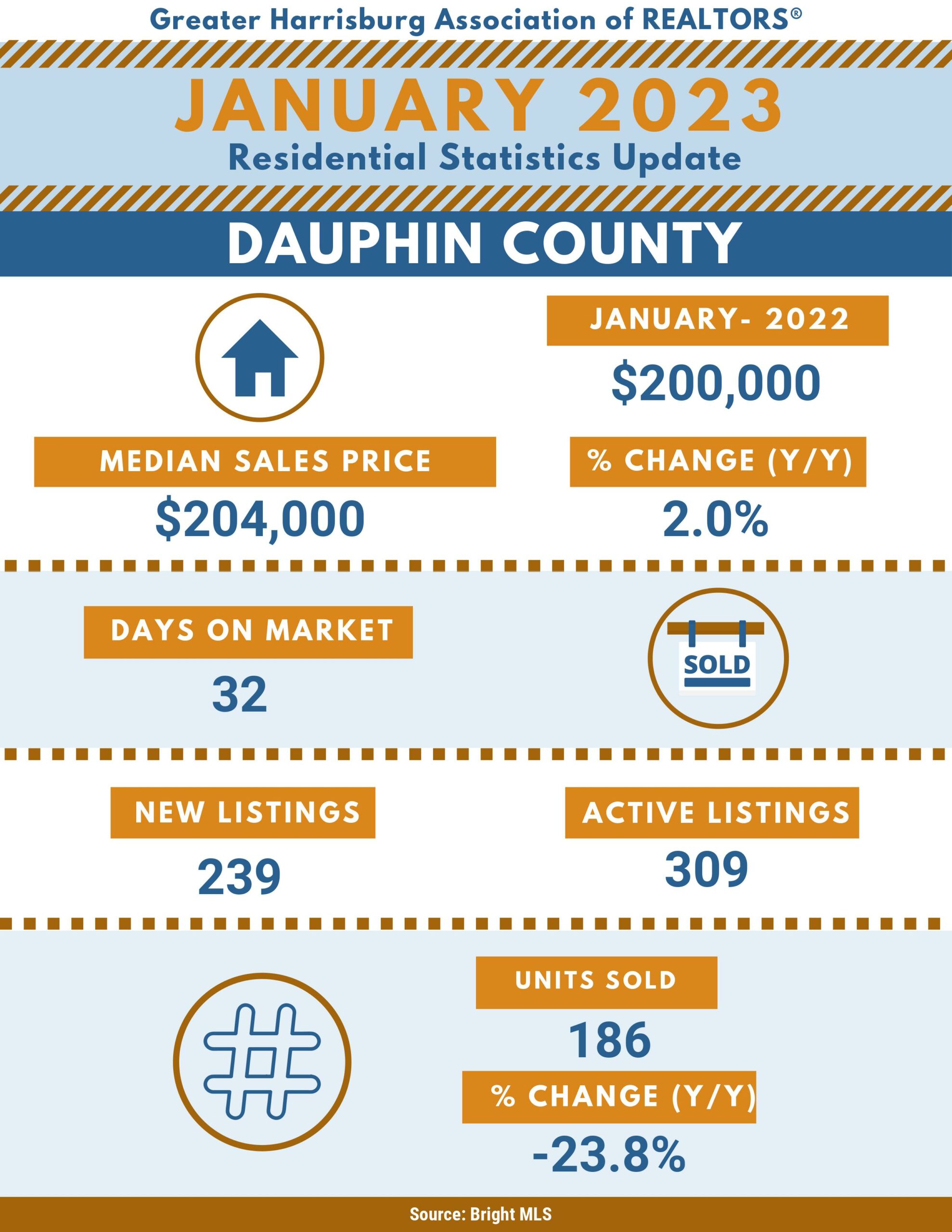

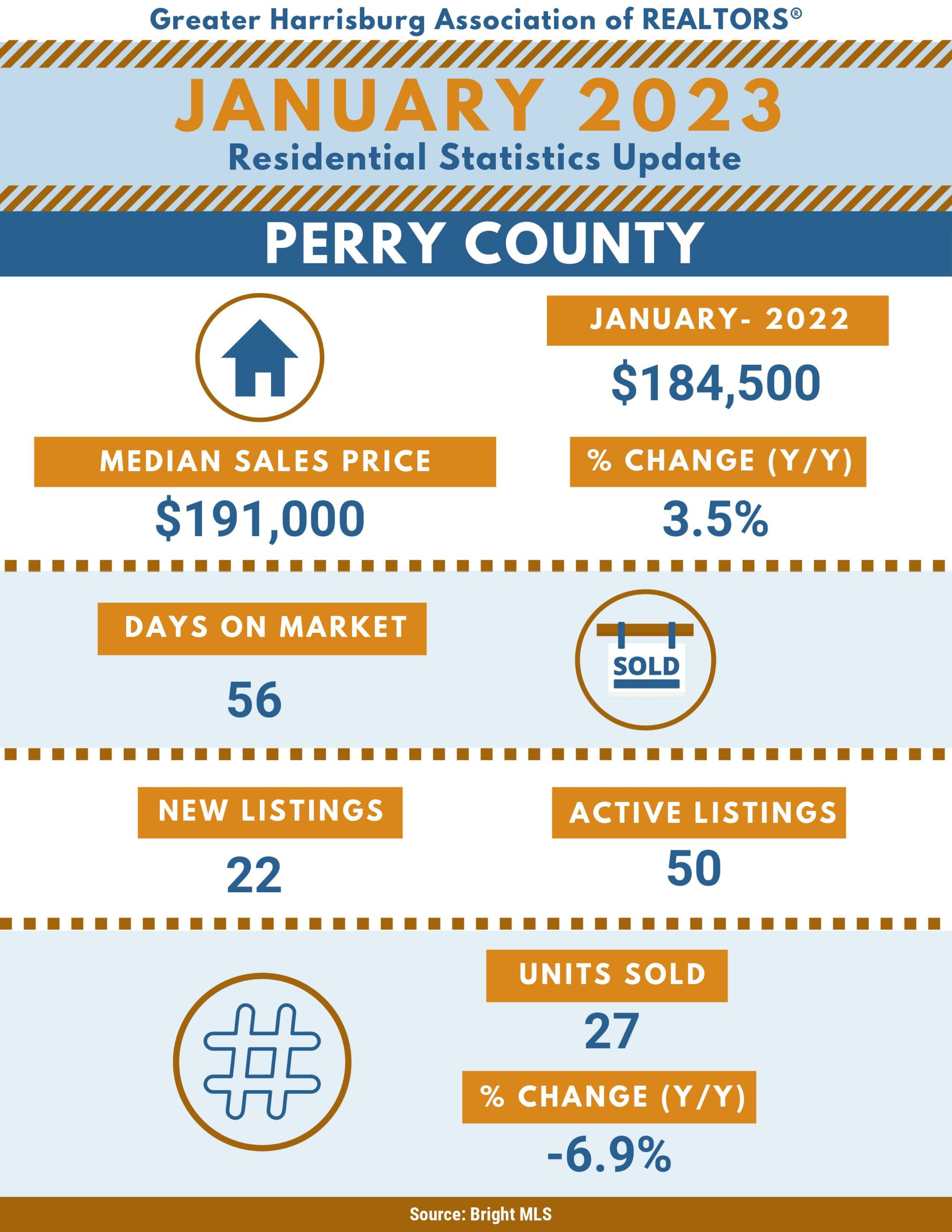

January 2023 Market Update

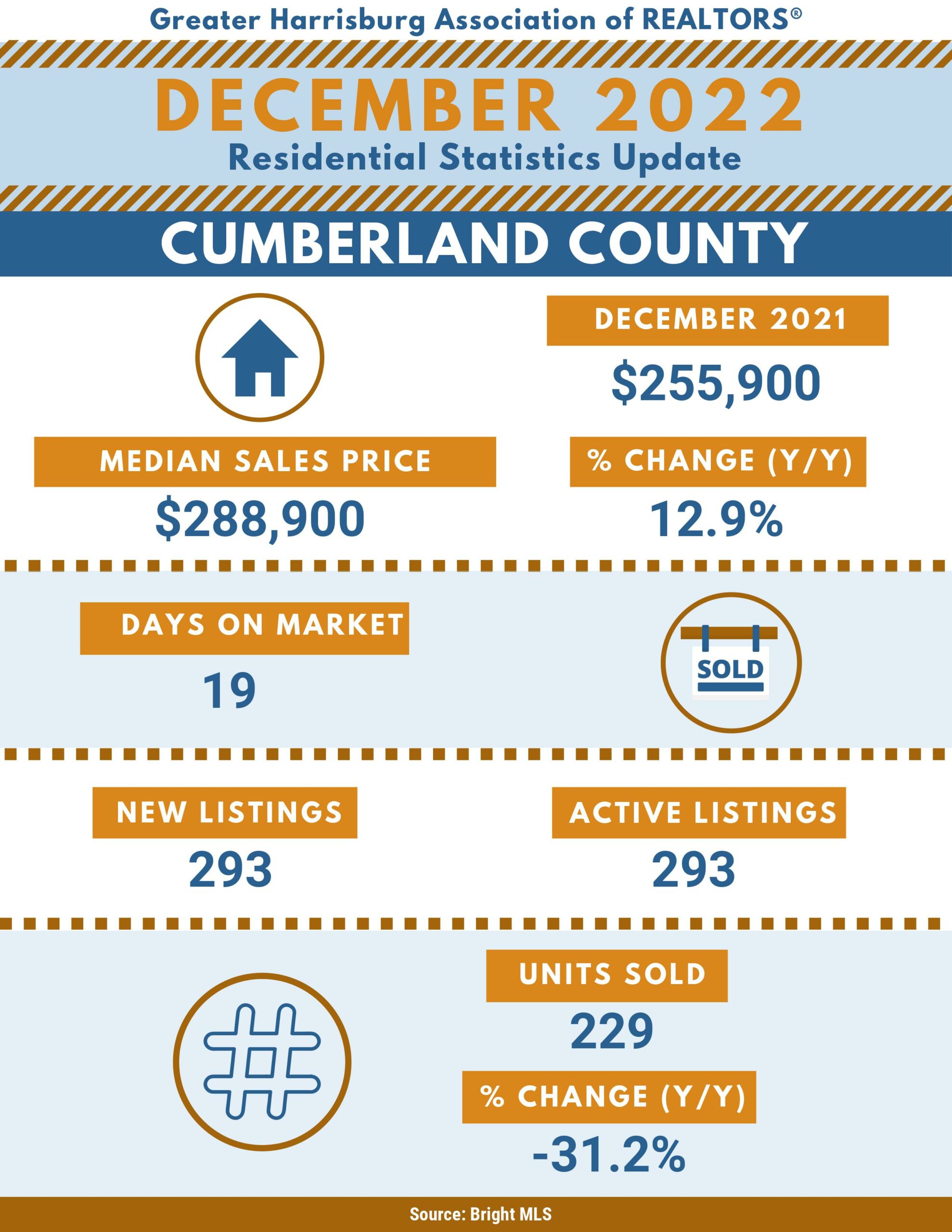

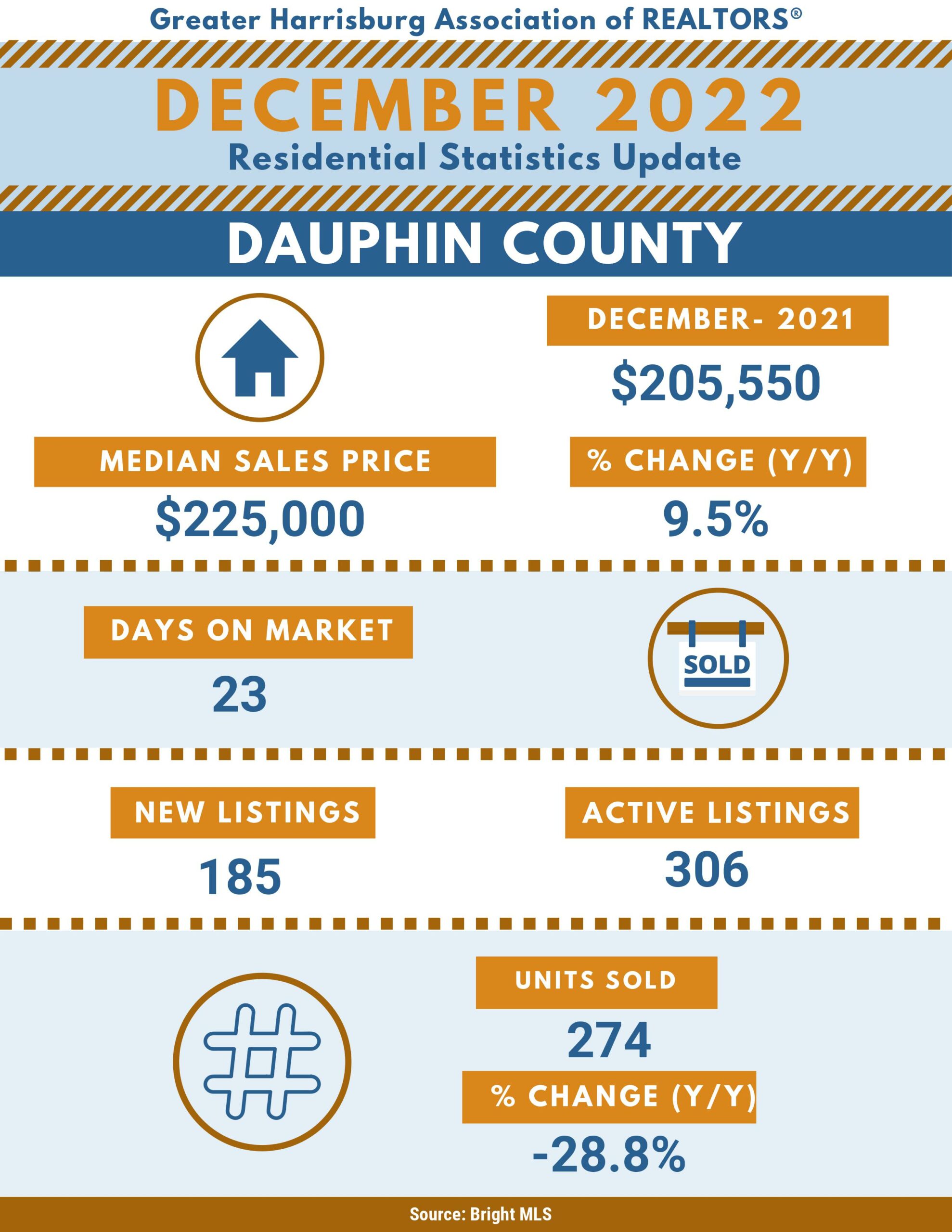

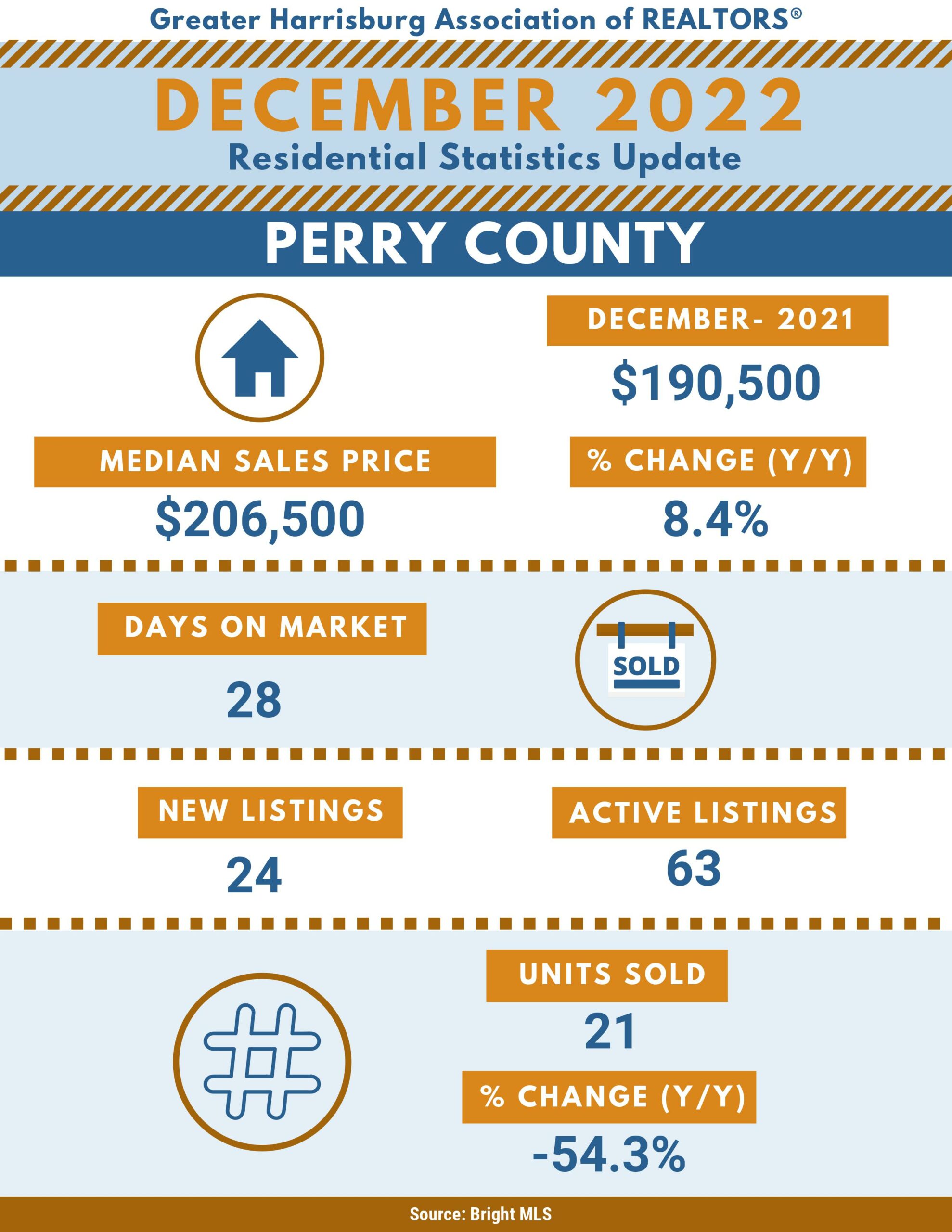

December 2022 Market Update

Apps to Make Saving Easier

Saving for a home, retirement, a vacation or anything else can be difficult.

The median retirement savings of all working-age families in the United States is $5,000, according to the Economic Policy Institute. Given that many financial advisers recommend having about $1 million in retirement, that leaves many families far short of their retirement plans.

Don’t let such big goals keep you from striving for them. Many mobile apps help people reach multiple savings goals, often in painless ways that only require the change you’d normally get at the cash register.

For a retirement plan, home down payment or other large financial goal, you’re probably best off by maximizing automatic paycheck deductions or contributing regularly to a savings account. For smaller savings goals, here are some apps to check out:

Qapital: Set multiple savings goals and have money moved into savings based on rules you set. The service is free.

You won’t have to sacrifice the things you love buying. Buying an espresso every morning at your local coffee shop? Tell the app to save $5 every time you buy coffee. Or it can round up that coffee purchase by a lower amount, such as moving a $3.50 coffee to $4 and putting that extra 50 cents in your account.

Digit: This service has a different way of helping users save money. It connects to your checking account and analyzes your income and spending and finds money it can set aside for you. It never transfers more than you can afford, so you don’t have to worry about overdrafting your account.

Digit used to be free, but now charges $3 per month for its service. A 100-day free trial is available.

Acorns: This micro-investing app turns every purchase you make into an investment.

It connects your accounts and cards that you use to make everyday purchases and rounds your purchases to the nearest dollar. That spare change is automatically invested. You can also set up recurring or one-time investments.

Acorns costs $1 per month to use. For accounts of $5,000 or more, the fee is 0.25 percent per year.

SmartyPig: This online saving account lets you save for specific goals by making automatic transfers from your linked bank account. Want to save for a new TV? SmartyPig can help you set up an account for that.

The service is free. Up to six withdrawals per account can be made each month.

Article courtesy of Institute for Luxury Home Marketing

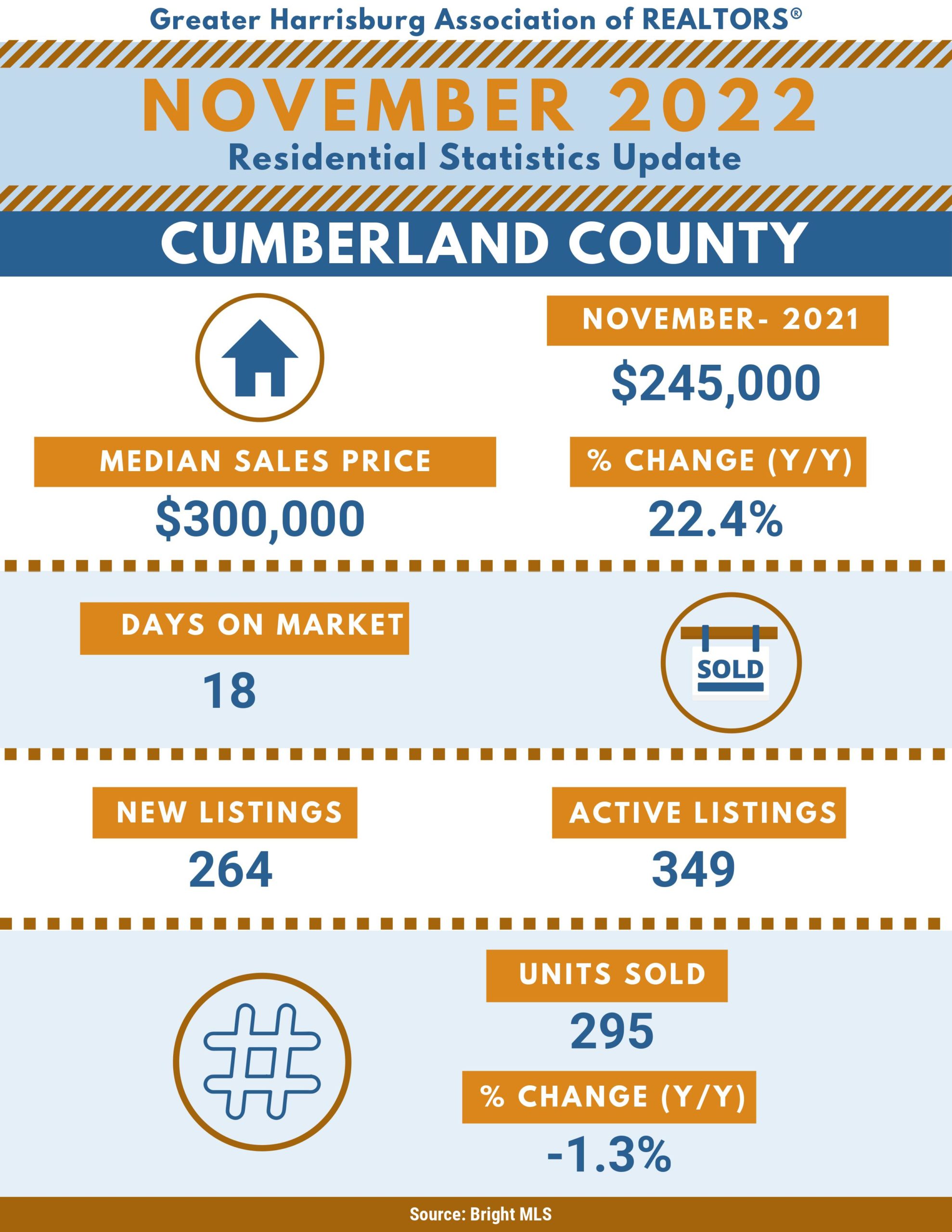

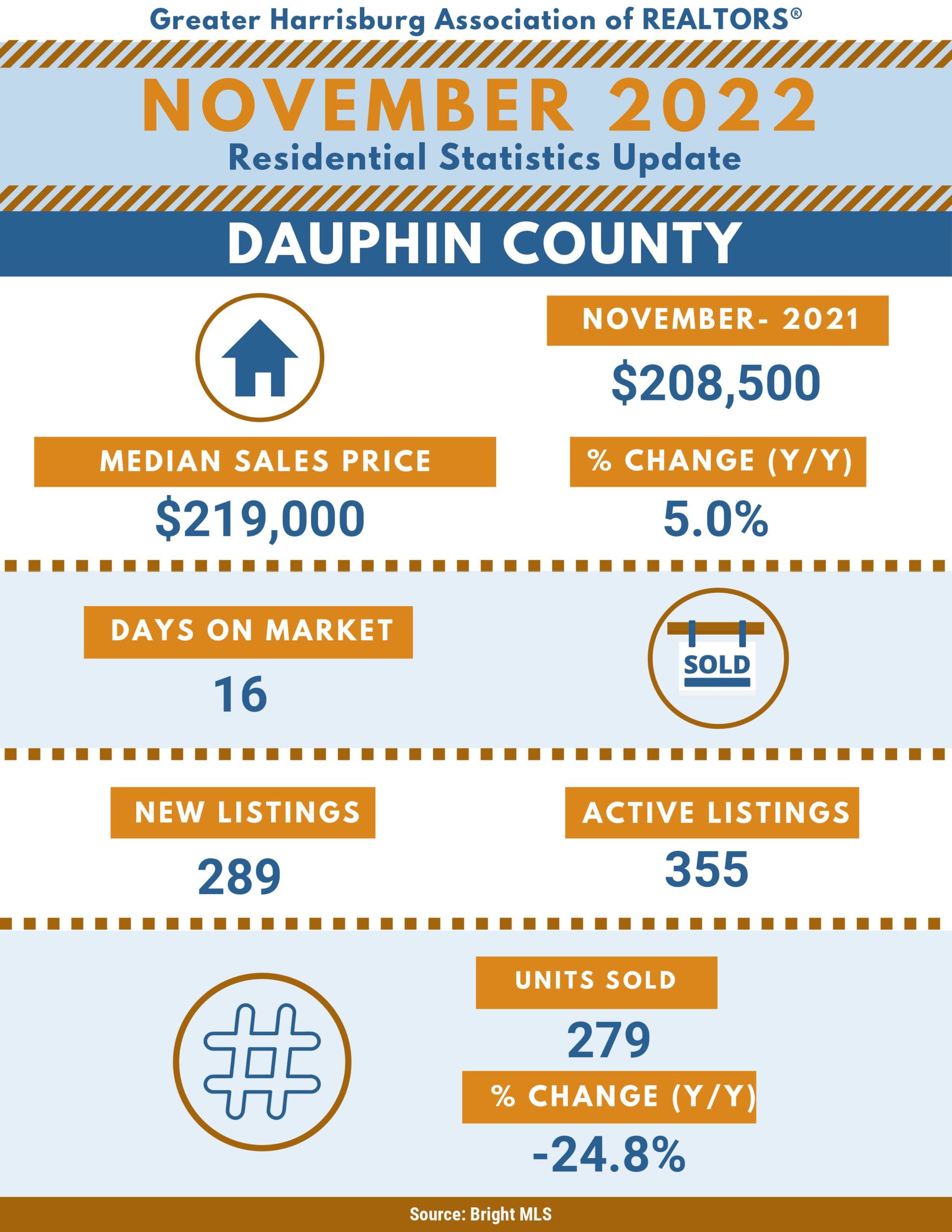

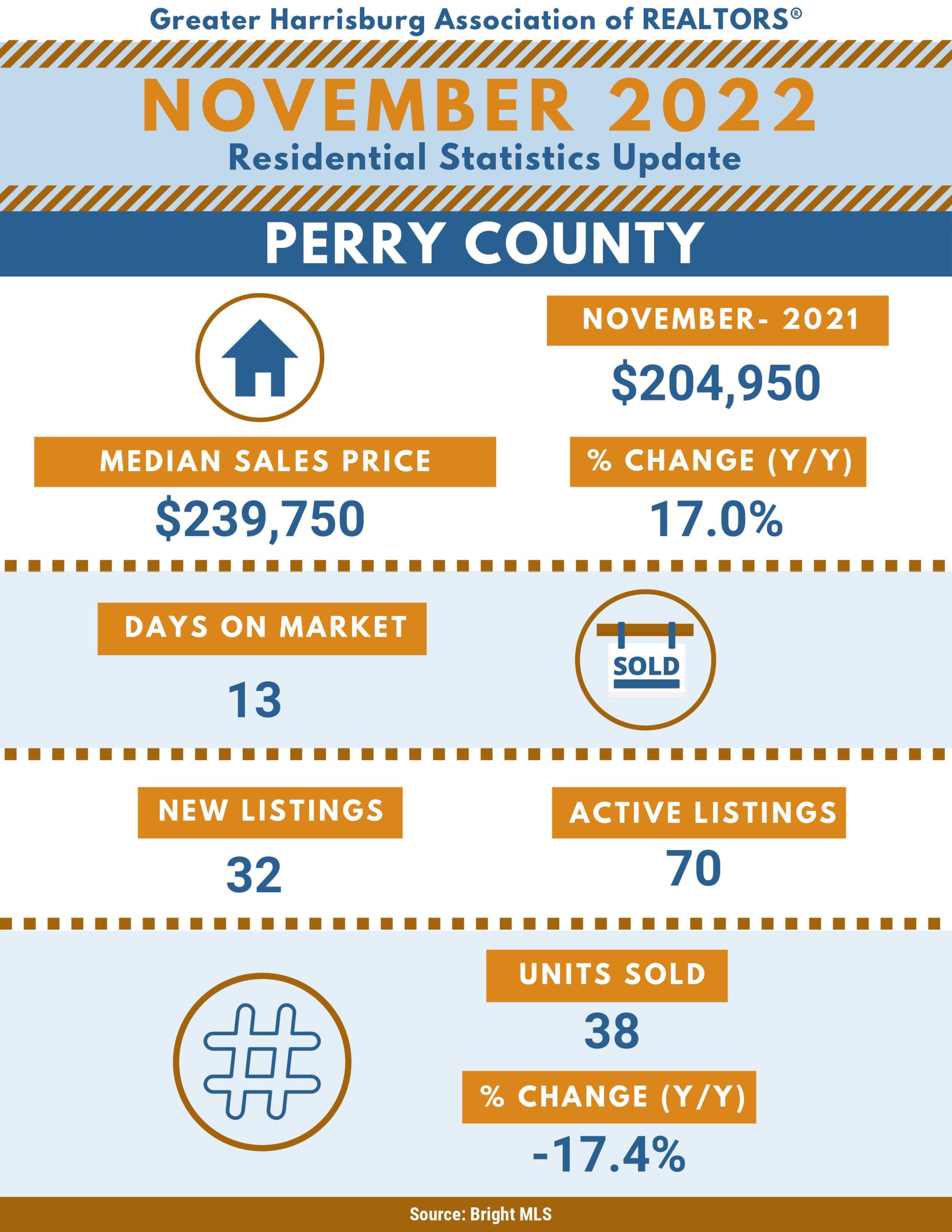

November 2022 Market Update

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve.

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve.