We all know about buyer’s remorse. What about seller’s regret? According to Zillow, 84% of those who sold a home for the first time between late 2020 and 2022 wish they did something differently. 39% of these sellers wish they set a higher listing price. Understanding the market to get the most optimal price is a common challenge. Market conditions this year might make it harder. High mortgage rates, falling demand, low inventory – we’re headed for a spring selling season unlike any other. Here’s how to lock in a price strategy before listing.

Determine Your Priorities

Ask yourself: Why am I selling, and how fast do I need to sell my home? Are you relocating for work and need to sell quickly? Or are you retiring, and need to maximize your nest egg? Figuring out a timeline, as well as how you will invest that money is a crucial first step in the sale process.

Find the Right Real Estate Agent

“This is a market where you really want a pro,” says Amanda Pendleton, a home trends expert at Zillow. Hire a professional who’s deeply experienced in your local market and has sold similar properties to your own. They should have insight on “every single competitor in the market and the differences between alternative homes and yours,” says John Walkup, co-founder of real estate data firm UrbanDigs.

Get a Comparative Market Analysis

A CMA will give you an in-depth report on your home’s current value, considering location, age, size, construction, style and condition, as well as other comparable properties, or “comps”, in your neighborhood. Use it as a starting point, or inspiration to make certain upgrades to boost the value of your home. Focus on recent sales, active listings, those in contract or homes that have been pulled off the market. Bedrooms, bathrooms, square footage, and amenities are important to consider.

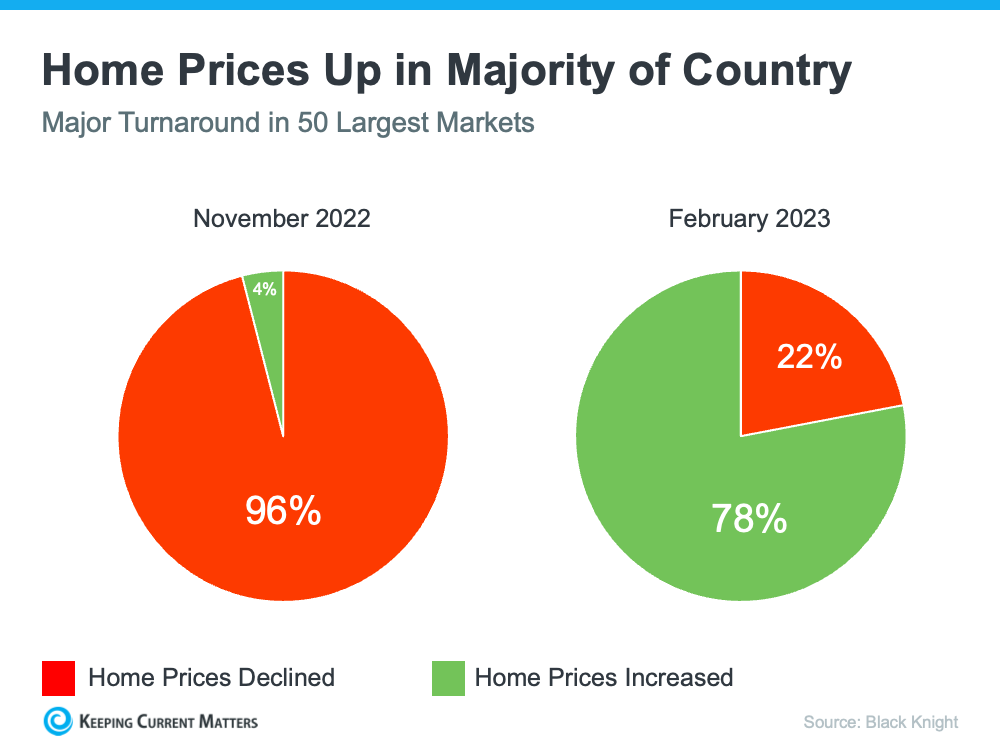

Meet the Market Where It’s At

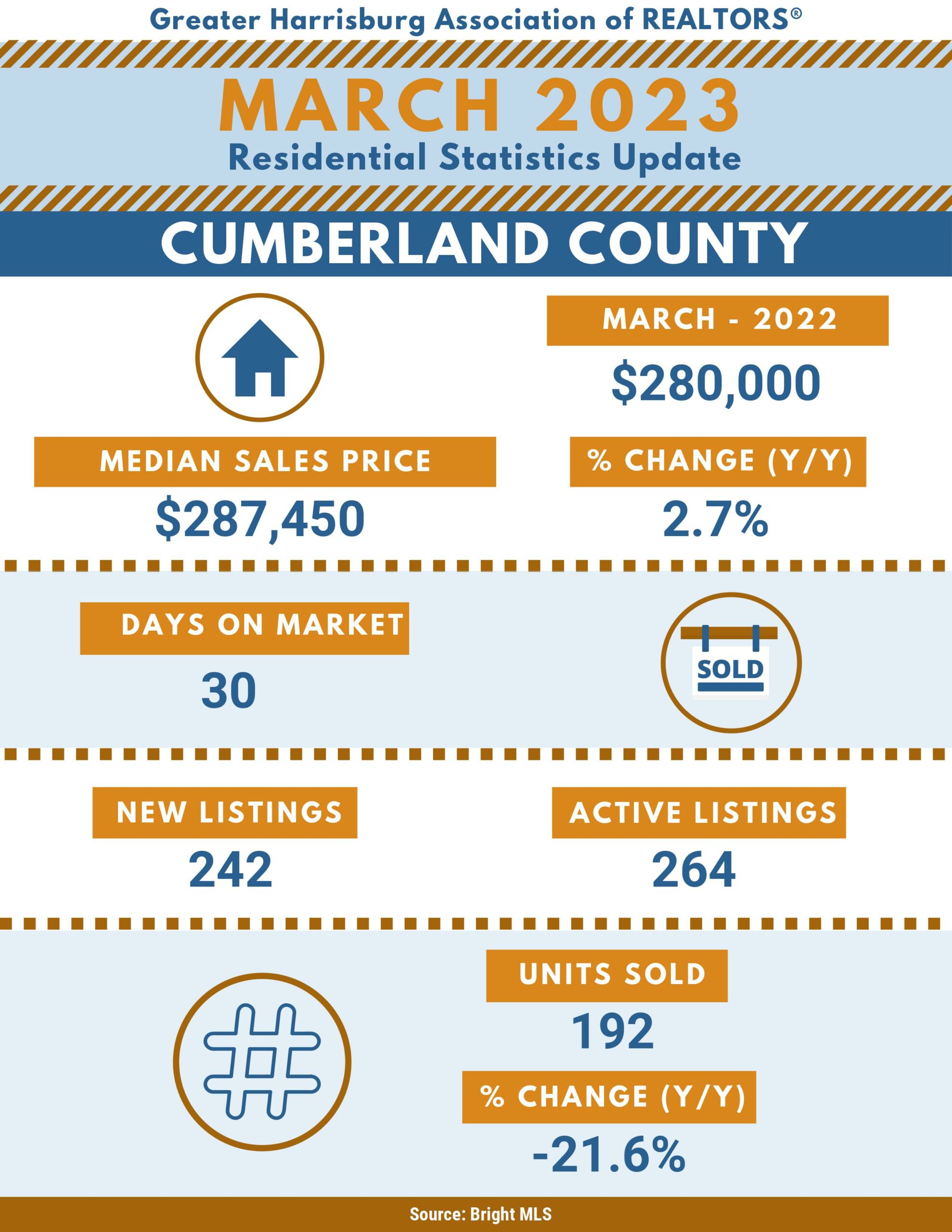

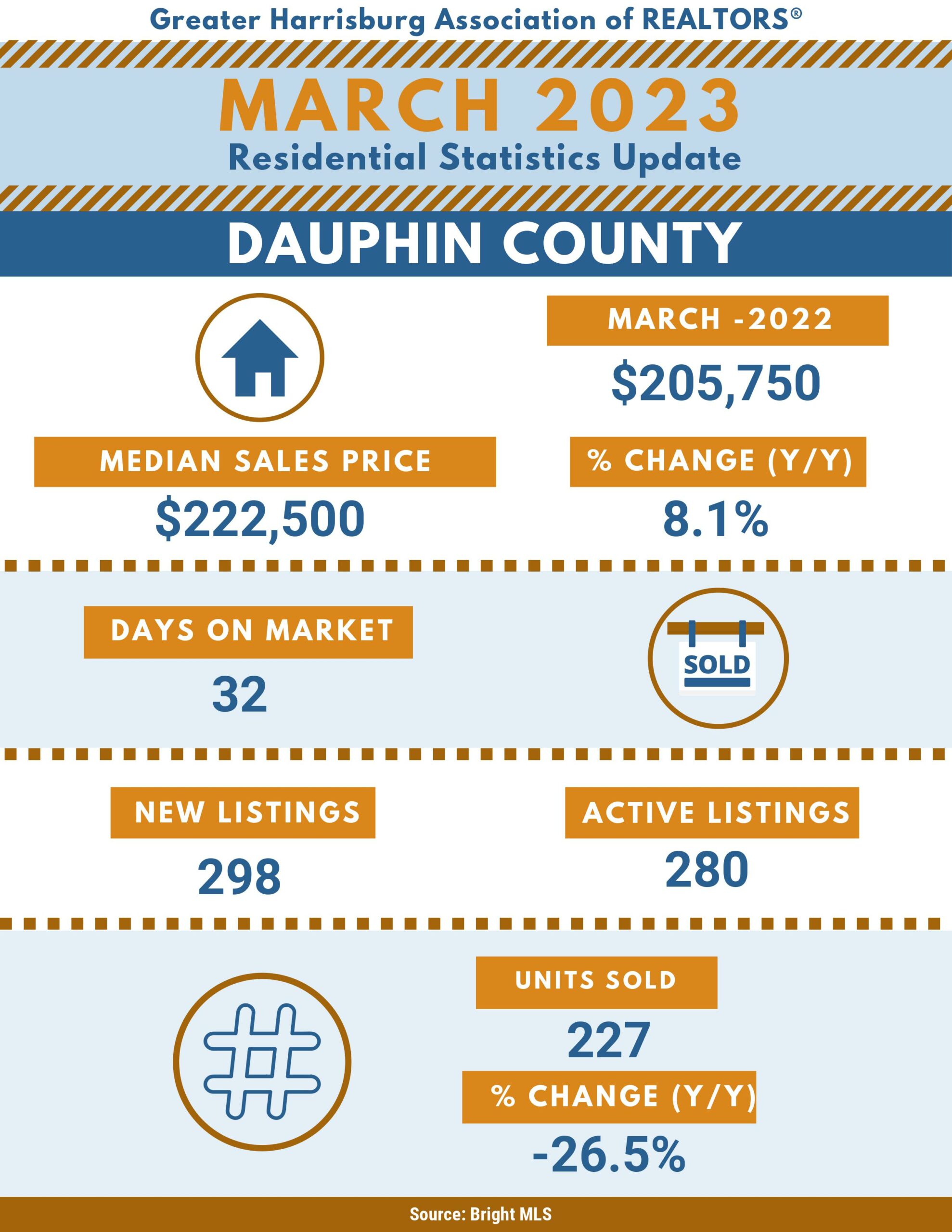

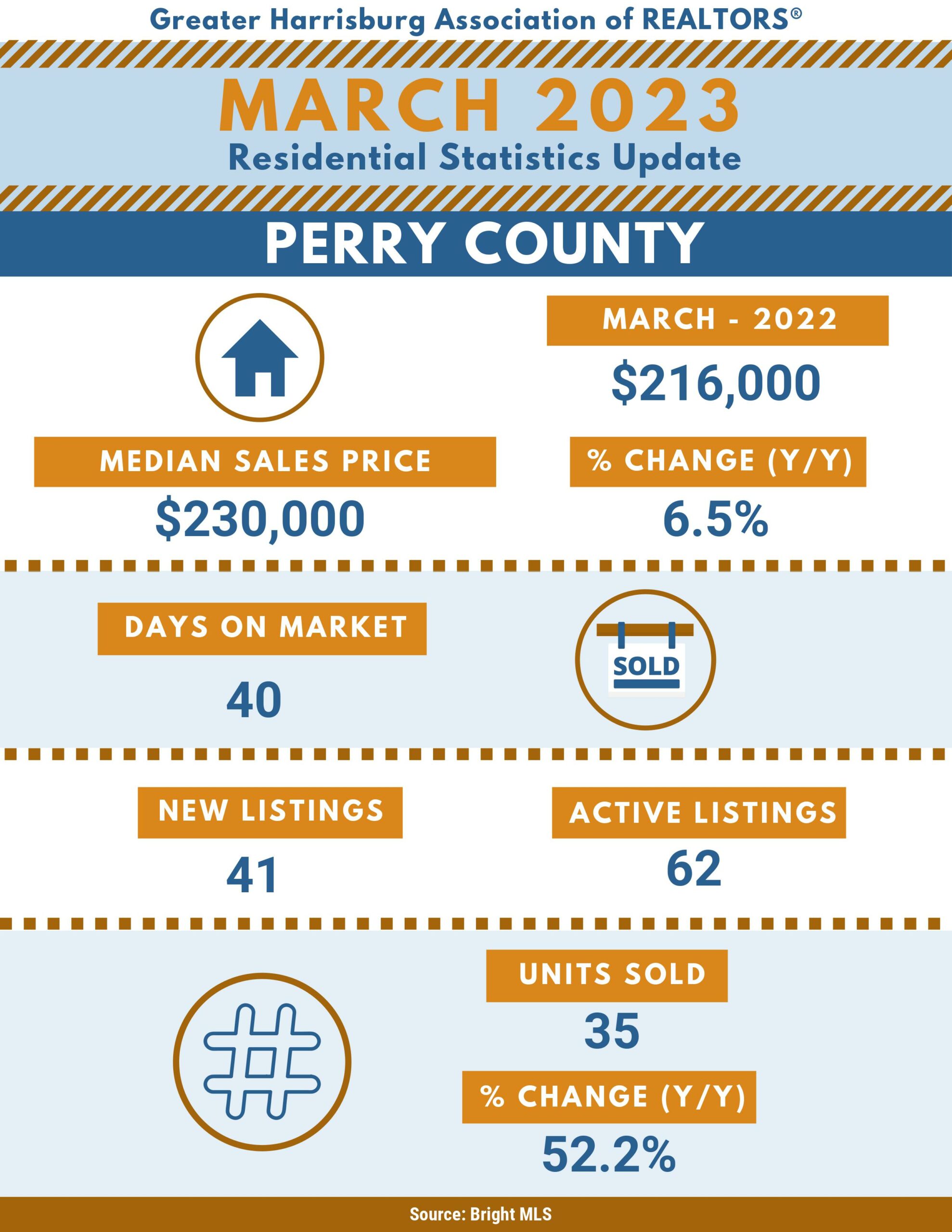

Mortgage rates are setting the tone for buyers across the country. In March, the typical monthly mortgage payment was up 26% compared to a year ago, according to Zillow. Buyers who could afford a $350,000 home in 2022 might not be able to anymore. You should consider rates, which change week to week, when coming up with your asking price, and how they’re affecting demand in your area.

Develop a Strategy

You want the best possible price for your home, but pricing it too high could lead to a slower sale and price cuts. “There are three basic pricing strategies: at, below, or above perceived market value,” says Mihal Gartenberg, a broker at Coldwell Banker Warburg. “The strategy that leads to the most showings, fastest close, and ability to close above ask is pricing below perceived market value.” If it’s under $1 million, she suggests pricing about $25,000 lower than the perceived market value, while higher price points round down $50,000 to $100,000. Mr. Walkup suggests that sellers determine a “best possible price” for their home, followed by a value proposition. Discounting your best possible price as little as 2% to 3% will bring more buyers in the door, he says.

Reassess After Two Weeks

Take an honest look at your listing about 14 days after it’s gone live. “Those first two weeks are critical – it’s when we see listings get the most traffic,” said Amit Arora of iBuying firm Opendoor. If you’re hearing crickets, it’s likely a sign your listing isn’t matching buyer expectations and it might be soon time to recalibrate.

Article Courtesy of The Wall Street Journal

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve.

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve.