If you put a pause on your home search because you weren’t sure where you’d go once you sold your house, it might be a good time to get back into the market. If you’re willing to work with a trusted agent to consider a newly built home, you may have even more options and incentives than you realize. That may be why the National Association of Home Builders (NAHB) says the share of buyers looking for new construction is increasing:

“According to the quarterly Housing Trends Report, the popularity of new construction homes is continuing to rebound . . .â€

Here’s a few reasons more buyers may be drawn to newly built homes.

When looking for a home, you can choose between existing homes (those that are already built and previously owned) and newly constructed ones. While the inventory of existing homes has increased this year, it’s still below more typical years like 2019. Currently, according to the National Association of Realtors (NAR), there is a 3.2-month supply at the current sales pace. For reference, a roughly 6-month supply is considered a balanced market, leaving us in a sellers’ market today.

While it’s a smaller segment of the overall inventory of homes for sale, the supply of newly built homes has grown even more. The National Association of Home Builders (NAHB) explains:

“New single-family home inventory remained elevated at a 9.2 months’ supply (of varying stages of construction). A measure near a 6 months’ supply is considered balanced.â€

Here’s why this matters for you. While you have more homes to choose from in either category, there’s one extra benefit of newly built homes. Because the inventory of newly built homes has grown so much, builders are motivated to sell their properties before they build more.

Back in the housing crash of 2008, builders were building too many homes, and that oversupply is part of what contributed to the housing bubble bursting. Now, builders don’t want to have a surplus of inventory in their pipeline, and many are offering buyers incentives to help move that inventory along. As Doug Duncan, Chief Economist at Fannie Mae, explains:

“. . . a continual increase in the number of completed homes available for sale is now occurring, with the inventories of such homes now at the highest level since July 2020. . . . This suggests to us that builders may be increasingly willing to offer more aggressive incentives and discounts to maintain sales of completed inventory.â€

While specifics will vary by builder and market, some buyers are seeing builders reduce prices and offer incentives. To find out what’s available in your area, lean on a trusted real estate professional.

In addition to more supply and the potential for builder incentives, newly built homes have various benefits that may suit your lifestyle. For example, you likely won’t have as many little repairs to tackle, like leaky faucets, shutters to paint, and other odd jobs around the house. That can free up time for you to do other things you’re passionate about.

Another perk of a new home is that nothing in the house is used. It’s brand new and uniquely yours from day one. You’ll have all new appliances, windows, roofing, and more. These things can help lower your energy costs, which can add up to significant savings over time. You may even have the latest and greatest technology features built into your new home.

Builder sums up why some buyers today are turning to newly built homes:

“For some, it’s the lure of something new and modern. For others, it’s the move-in ready experience. And now there’s another factor to consider when making this decision: technology.â€

If any of these benefits appeal to you, it’s time to connect with a trusted real estate advisor to learn more.

If you’re considering a newly built home, working with a real estate agent is mission critical. They’ll be your expert guide on what’s available in your local market and can help you explore your options and the benefits of an all-new home.

Article Courtesy of Keeping Current Matters

Everybody wants to save money to buy a house, take a vacation or be able to retire comfortably. If you have limited income, those goals can seem out of reach. It can be hard to save money if you don’t have much coming in, but there are ways that you can trim your spending and be able to set some money aside for the future.

Cut Expenses

For most families, housing is the biggest monthly expense. If you own a house, consider refinancing your mortgage to lower your monthly payments. That will extend the term of the loan, which means it’ll take you longer to pay it off, but you could save hundreds of dollars a month that you could put toward saving for retirement or your children’s college education. If your children have moved out, consider renting out a spare room or downsizing to a smaller house or apartment.

Entertainment can be expensive. Cable often starts out at a low introductory rate that increases after a period of time. Ask yourself if you really need all of the channels you currently have, or if you even need cable at all. There are many other services that offer access to thousands of programs at a fraction of the cost.

Eating out and grabbing a cup of coffee here and there can quickly add up. Eat breakfast at home or take something with you to eat at work. Instead of going out for lunch, pack a sandwich. Cook dinner at home instead of going to a restaurant. You can still go out to eat once in a while, but limiting yourself to once or twice a week can save you a ton of money over the course of the year.

Pay Off Debt

If you have debt, come up with a plan to pay it off. Make a list of all of your credit card balances, outstanding car and student loans, and other debts, along with the interest rates. Create an ambitious but realistic plan to pay them off, starting with the one with the highest interest rate. You might be able to refinance a loan to a lower interest rate or take advantage of a credit card balance transfer offer that can significantly lower your interest rate and give you time to pay off the bill without accumulating a lot of additional costs.

Save for the Future

If your employer offers a retirement plan, you should take advantage of it, especially if the employer provides a match. That’s basically free money that the employer offers to help you plan for your future.

Saving Money Is Doable

If you have a limited income, you may feel like saving money is impossible, but it isn’t. Trimming expenses, lowering interest rates, paying off debt and taking advantage of help offered by your employer can allow you to get on firmer financial ground.

Article courtesy of Institute for Luxury Home Marketing

The best way to improve your credit score is simple, but not always that easy: Reduce your debt.

Paying off your credit cards, or at least paying them down substantially, will not only increase your credit score, but having less debt will probably be more satisfying than a great credit score. And not using your credit cards anymore and paying off the balances is easier said than done.

But there are smaller, easier steps that can improve a credit score. Here are six:

Set payment reminders: Making credit payments on time is one of the best ways to improve your credit score. Set payment reminders on your phone or whatever calendar you use, and check if your bank offers online reminders through email or text messages.

Don’t open new accounts: If you have a short credit history, then opening a lot of credit accounts too rapidly will lower your average account age and can drop your scores if you don’t have a lot of other credit information.

Fix errors: Get a copy of your credit report and check it for errors. These can include accounts that are listed as open but closed, incorrect late payments and wrong personal information, such as your birthday. If you find any credit report errors, fix them online with the credit reporting agencies.

Don’t move debt around: How much you owe accounts for 30 percent of a FICO credit score, one of the most common types of credit score. It can be tempting to pay off one credit card with another, but that type of shell game can hurt a credit score. Instead, pay down the debt and have fewer open accounts.

Don’t max out: Stay away from hitting the top of your credit limit on your credit cards so that your credit utilization level is low. Credit utilization is the amount of your credit card balance relative to your credit limit. The higher it is, the worse it can affect your credit score.

This may be easier said than done, but keeping balances to 30 percent or less of your credit limits will improve a credit score just as much as paying your credit bills on time will.

Pay your bills twice a month: This is easier than you think and can be done with the same amount of money you were going to pay for the full month anyway.

If you’re paying down a credit card with $500 per month, for example, pay half of it just before the statement closing date and the second payment just before the due date. The first will reduce the balance that credit bureaus see and the second will ensure you won’t pay a late fee.

Article courtesy of Institute for Luxury Home Marketing

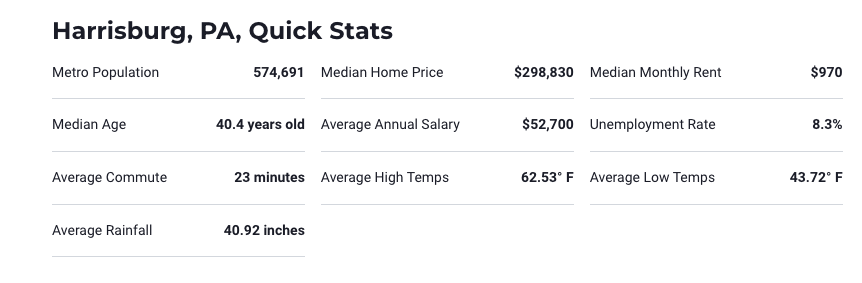

U.S. News analyzed 150 metro areas in the United States to find the best places to live based on quality of life and the job market in each metro area, as well as the value of living there and people’s desire to live there. Harrisburg, PA was voted #2 best places to retire!

Harrisburg is within easy driving distance of Amish country, Gettysburg National Military Park, and Hersheypark – with its amusement park, concert series, and The Spa At The Hotel Hershey, famous for its chocolate treatments. Big-city weekend getaways are also there for the taking; New York City, Philadelphia, Baltimore, and Washington, D.C., are a few hours away by car.

When it comes to entertainment, the metro area’s small size means limited options for eating out and nightlife in general. But those who live here aren’t bored.

The great outdoors are easily accessible in Harrisburg – Pennsylvania’s capital. Bikers and runners take in the scenery of the Susquehanna River on the trails of Riverfront Park, which also hosts many of the metro area’s annual festivals and events. Residents also enjoy hiking the famous Appalachian Trail or camping and mountain biking in the many nearby state parks and forests.

Music lovers can attend concerts at local arenas and experience live music at area coffeehouses and bookstores. Harrisburg also features many galleries and museums, such as the Susquehanna Art Museum, and local artist exhibits at the Art Association of Harrisburg. Theatre Harrisburg, Open Stage of Harrisburg, and the Harrisburg Area Community College’s Rose Lehrman Arts Center offers regular performances.

To enjoy the area’s history, locals head to the National Civil War Museum and The State Museum of Pennsylvania.

While Harrisburg isn’t necessarily regarded as affluent, it has a more affordable housing market and a lower cost of living than many of the East Coast’s larger metro areas.

Article Courtesy of US News

2101 Market Street

Camp Hill, PA 17011

717.409.6500 Office | 717.645.7152 Cell

Contact Michael

Schedule An Appointment Today!

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve. Meet Michael Pion

A top-producing agent in the Central Pennsylvania real estate market since 2001, Michael has what it takes to get you the results you deserve. Meet Michael Pion